Buying a home with active solar panel lease

T B

last year

Featured Answer

Sort by:Oldest

Comments (7)

kevin9408

last yearlast modified: last yearT B

last yearRelated Professionals

Clive Architects & Building Designers · New Bern General Contractors · Country Club Hills General Contractors · Deer Park General Contractors · Galveston General Contractors · Halfway General Contractors · Hartford General Contractors · Jacksonville General Contractors · Riverdale General Contractors · Stillwater General Contractors · Wallington General Contractors · Wolf Trap General Contractors · Kailua Home Stagers · Round Lake Home Stagers · Arkansas Interior Designers & Decoratorskevin9408

last yearelcieg

last yearlast modified: last yearhomechef59

last yearbry911

last year

Related Stories

GREEN BUILDINGGoing Solar at Home: Solar Panel Basics

Save money on electricity and reduce your carbon footprint by installing photovoltaic panels. This guide will help you get started

Full Story

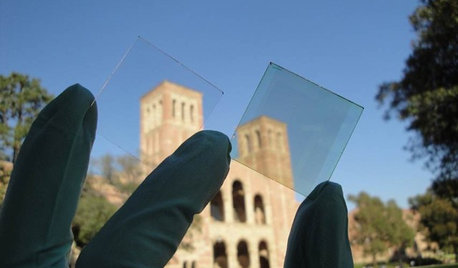

GREEN BUILDINGLet’s Clear Up Some Confusion About Solar Panels

Different panel types do different things. If you want solar energy for your home, get the basics here first

Full Story

REMODELING GUIDESHigh Design With Solar Panels

Solar panels find new function as elements of smart home design

Full Story

HOME TECHSmall Solar: Big Home Tech Trend in the Making

New technology enables everyday household objects to power themselves by harnessing natural light

Full Story

MOVINGHome-Buying Checklist: 20 Things to Consider Beyond the Inspection

Quality of life is just as important as construction quality. Learn what to look for at open houses to ensure comfort in your new home

Full Story

HOUZZ CALLHow Are You Staying Active at Home?

Have you turned a bedroom into a home gym or planted a flower bed? Tell us how you’re getting exercise around the house

Full Story

GREEN BUILDINGSunlight Used Right: Modern Home Designs That Harness Solar Power

Embracing passive heating principles through their architecture, siting and more, these homes save energy without skimping on warmth

Full Story

FEEL-GOOD HOME9 Ways to Boost Your Home’s Appeal for Less Than $75

Whether you’re selling your home or just looking to freshen it up, check out these inexpensive ways to transform it

Full Story

BUDGET DECORATING9 Tricks to Boost Your Home’s Appeal for Less Than $400

Whether you’re redecorating or just doing a quick update, check out these ways to enhance your home on a budget

Full Story

ROOFSWhat to Know Before Selecting Your Home’s Roofing Material

Understanding the various roofing options can help you make an informed choice

Full Story

Louise Smith